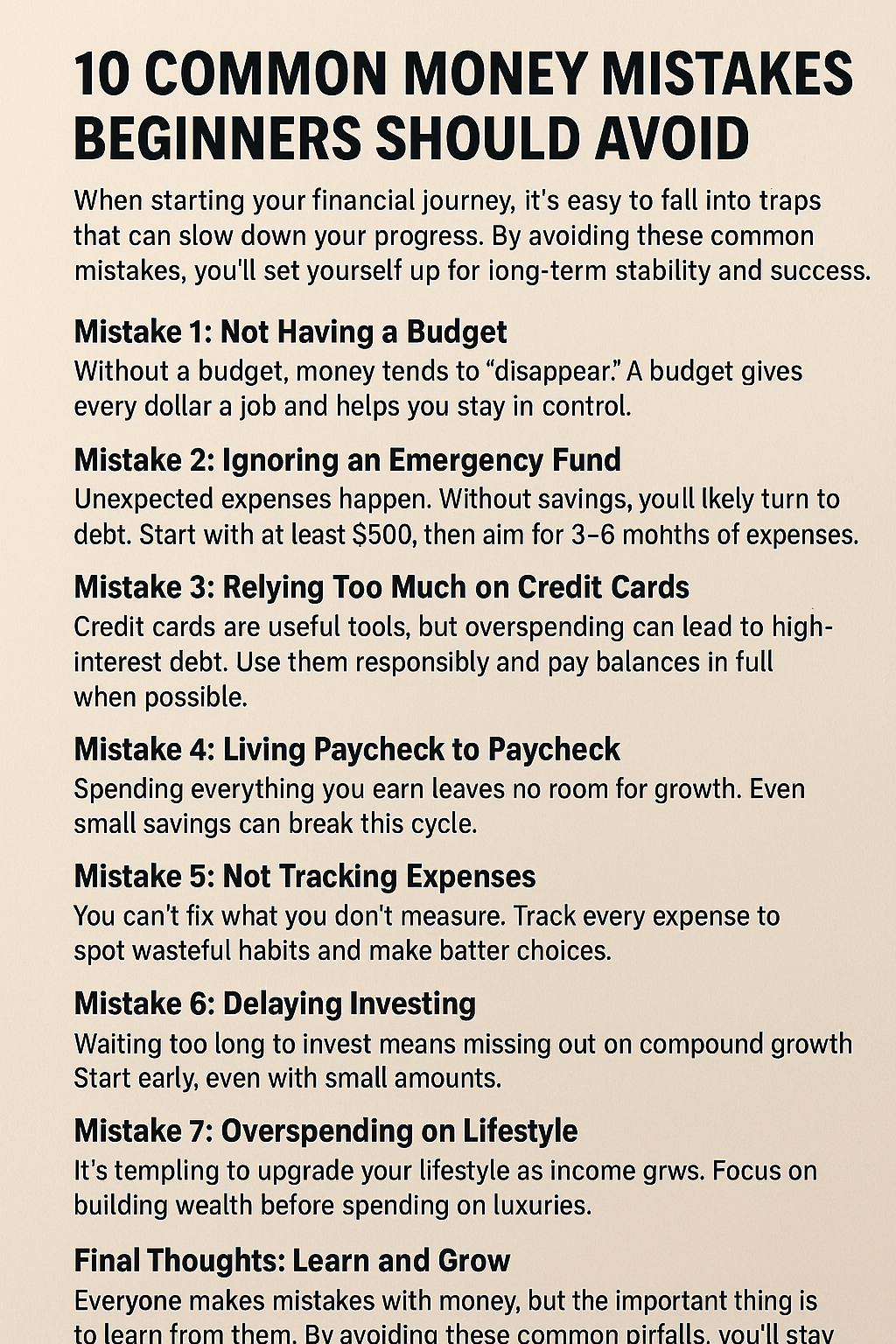

When starting your financial journey, it’s easy to fall into traps that can slow down your progress. By avoiding these common mistakes, you’ll set yourself up for long-term stability and success.

Mistake 1: Not Having a Budget

Without a budget, money tends to “disappear.” A budget gives every dollar a job and helps you stay in control.

Mistake 2: Ignoring an Emergency Fund

Unexpected expenses happen. Without savings, you’ll likely turn to debt. Start with at least $500, then aim for 3–6 months of expenses.

Mistake 3: Relying Too Much on Credit Cards

Credit cards are useful tools, but overspending can lead to high-interest debt. Use them responsibly and pay balances in full when possible.

Mistake 4: Living Paycheck to Paycheck

Spending everything you earn leaves no room for growth. Even small savings can break this cycle.

Mistake 5: Not Tracking Expenses

You can’t fix what you don’t measure. Track every expense to spot wasteful habits and make better choices.

Mistake 6: Delaying Investing

Waiting too long to invest means missing out on compound growth. Start early, even with small amounts.

Mistake 7: Overspending on Lifestyle

It’s tempting to upgrade your lifestyle as income grows. Focus on building wealth before spending on luxuries.

Mistake 8: Ignoring Debt

Ignoring debt doesn’t make it go away. Create a plan to pay it off systematically.

Mistake 9: Not Setting Financial Goals

Without goals, it’s hard to stay motivated. Whether it’s saving for a trip or retirement, set clear, realistic targets.

Mistake 10: Failing to Educate Yourself

Financial literacy is key. Read books, follow trusted resources, and keep learning about money management.

Final Thoughts: Learn and Grow

Everyone makes mistakes with money, but the important thing is to learn from them. By avoiding these common pitfalls, you’ll stay on the path to financial freedom and security.